Mortgage rates are trending down! 30-year fixed rates average 6.93%, a drop from last week, with top lenders offering rates below 6.5%.In the ever-changing geography of the casing request, one thing that remained constant in 20XX was the nonstop decline of mortgage rates. As the time comes to a close, let’s explore how this trend has affected the world of mortgage loans and homeownership. Before we claw into the current mortgage rate trends, let’s get a firm grasp of what a mortgage loan is.

In simple terms, a mortgage loan is a fiscal arrangement that allows individualities to buy a home by adopting a plutocrat from a lender. The borrower agrees to pay back the loan over a specified period, generally 15 to 30 times, along with interest.

Types of Mortgage Loans Mortgage loans come in colorful flavors, feeding different fiscal situations.

Then are some common types

- Interest-Only Mortgage

A fixed-rate mortgage offers security by maintaining the interest rate throughout the term.

- malleable- Rate Mortgage (ARM)

In discrepancy, an ARM has an interest rate that can change periodically. While originally offering lower rates, they can change, potentially adding your yearly payments.

- Mortgage Loan Calculator

Your Handy Tool Before diving into the mortgage request, it’s pivotal to use a mortgage loan calculator. These online tools help you estimate your yearly payments, including star and interest. Simply input the loan quantum, interest rate, and term, and voila! You have an idea of what to anticipate.

Mortgage Loan Rates Today

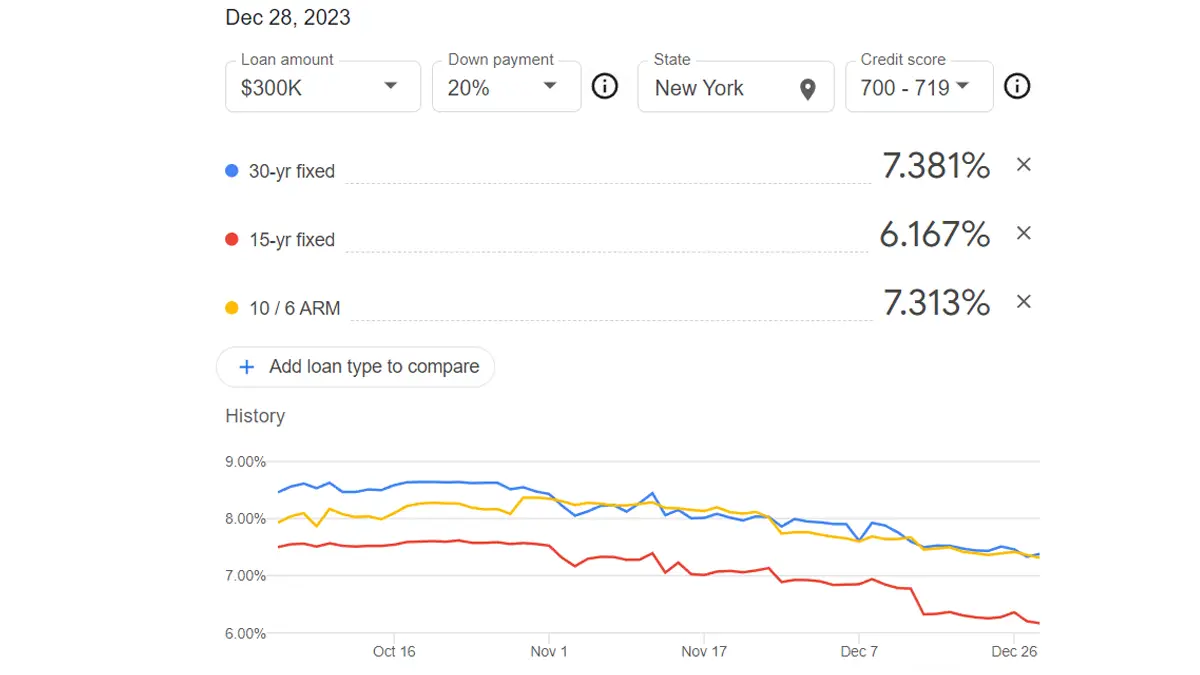

Let’s shift our focus to the heart of the matter-current mortgage rates. As of December 28th, the average 30-time fixed-rate mortgage stands at 6.61, a slight drop from the previous week’s6.67. A time ago, it equaled 6.42. This downcast trend has brought relief to numerous aspiring homeowners.

For those seeking a shorter loan term, 15-time mortgage rates now sit at 5.93, down from 6.95 the previous week. This reduction in interest rates offers a seductive option for borrowers looking to pay off their homes briskly.

It may be disheartening to try to find a way through the complex mortgage loan process, particularly if your credit is less than ideal. Mortgage brokers troll this area. This is where mortgage brokers come by. They serve as interposers between borrowers and lenders, helping you find stylish mortgage deals, indeed if you have bad credit. Some indeed offer mortgage loan blessing services to simplify the process.

Applying for a Mortgage Loan Getting a mortgage loan blessing involves a thorough operation process.

Then is a simplified overview

1. Gather Necessary Documents Prepare your fiscal documents, including duty returns, pay remainders, bank statements, and identification.

2. Choose a Lender Shop around and compare lenders. Consider factors like interest rates, freights, and client service.

3. Fill out the operation Complete the mortgage loan operation form handed by your chosen lender. Be honest and accurate when furnishing information.

4. Get Preapproved Getting preapproved is a significant step in the mortgage operation process. It shows merchandisers that you’re a serious buyer and can expedite the ending process.

The Best Banks for Mortgage Loans

When searching for mortgage loans, you might wonder which banks offer stylish deals. While the answer may vary depending on your position and credit history, some well-known institutions, similar to Bank of America, are famed for their mortgage immolations. It’s essential to compare rates and terms from different banks to find the stylish fit for your requirements.

Your income plays a vital part in determining the quantum you can adopt. Lenders assess your income to ensure you can meet your yearly mortgage scores comfortably. Understanding your debt-to-income rate is pivotal in this regard.

The casing request has endured significant ups and campo throughout 2023. Despite advanced mortgage rates, home prices have continued to climb. Nationwide, home prices are now 4.8 more advanced than a time ago. The S&P CoreLogic Case- Shiller indicators report reveals that 10- and 20- 20-megacity compound indicators are up 5.7 and 4.9, independently.

Mortgage Loan Calculator: Simply Enter The Following Information

| Item | Value |

| Principal | $200,000.00 |

| Interest Rate | 5.00% |

| Loan Term | 30 years |

| Monthly Payment | $833.33 |

A Brighter Outlook

The good news is that the rapid-fire descent of mortgage rates in the last two months has stabilized the casing request. According to Freddie Mac Chief Economist Sam Khater, the frugality remains robust, with solid growth, a tight labor request, and braking affectation. This, coupled with an incipient answer in the casing request, paints a positive picture for prospective homebuyers.

The part of Mortgage Rates

It’s pivotal to fete the vital part mortgage rates play in the casing request. While home prices remain high, mortgage rates significantly impact affordability and overall casing exertion. The time 2023 has seen a rollercoaster lift in the casing request, but it ends positively with declining mortgage rates.

Understanding mortgage loan options, rates, and the casing request’s dynamics is essential whether you are a first-time homebuyer or considering refinancing your mortgage. You can confidently make informed opinions and embark on your homeownership trip with the correct information and tools.

Changing mortgage rates may save you a lot of plutocrats over time. Then is a quick comparison of the current stylish rates for popular loan types:

| Loan Type | Average Rate | Top Lender(s) |

| 30-Year Fixed | 6.93% | Better.com (6.25%), LoanDepot (6.375%), Rocket Mortgage (6.42%) |

| 15-Year Fixed | 5.81% | Better.com (5.25%), LoanDepot (5.375%), Rocket Mortgage (5.42%) |

| 5/1 ARM | 6.375% | United Wholesale Mortgage (6.00%), NewRez (5.75%), and loanDepot (5.875%). |

| 7/6 ARM | 6.375% | 5.75% for NewRez, 5.875% for loanDepot, and 6.00% for United Wholesale Mortgage. |

| Jumbo Loan (30-Year Fixed) | 7.25% | Next on the list are loanDepot(7.00%), NewRez(6.75%), and Guild Mortgage (6.75%). |

So, What is Coming?

As we enter the new period, it’s pivotal to nearly cover the progress of containing requests. Real estate experts prognosticate high demand for parcels in early 2023, which would probably lead to price pressure, analogous to what happened in the former time. house prices should continue to rise periodically, and this trend should pick up brume in the months ahead as long as mortgage rates stay low. Pending house deals in November were flat compared to October, indeed though mortgage rates were lower. According to the National Association of Realtors (NAR), they are also5.2 lower than in November of the former time. still, there’s a tableware stuffing.

+ There are no comments

Add yours