In the world of medicine, improvements are frequently nearly covered and can lead to significant request responses. One similar recent development involves Cytokinetics (CYTK.O), a biopharmaceutical company grounded in South San Francisco, California. Cytokinetics has been making swells in the assiduity with its experimental heart complaint medicine, Alicante, and its promising performance in a late-stage study.

Cytokinetics lately blazoned that its experimental heart complaint medicine, Alicante, successfully met the main thing in a late-stage study. This achievement has put Cytokinetics on the path to contending with a rival treatment from Bristol Myers Squibb (BMY.N), a significant player in the pharmaceutical assiduity.

The data from the study has garnered enthusiastic responses from judges who have dubbed it a “home run” They’ve also noted that Aficamten’s safety and efficacity compare positively to Bristol’s Camzyos, adding to the excitement girding Cytokinetics’ eventuality.

The request responded fleetly to this positive news, with shares of Cytokinetics surging over 80 to reach a further than 19-time high of $ 83.82. This swell potentially adds as much as $ 3.74 billion to the company’s requested capitalization, pressing the significant impact of this development.

Critic Justin Kim from Oppenheimer has emphasized the strong connection between the success of the company and the study’s outgrowth. He predicts that Cytokinetics could induce roughly 2 billion in peak U.S. deals, italicizing the substantial profit eventuality of Alicante.

Understanding Aficamten’s Impact

Aficamten has shown remarkable results in perfecting cases’ exercise capacity, which was the primary thing of the study. After 24 weeks of treatment, peak oxygen capacity, measured in millilitres per nanosecond per kilogram of body weight, was bettered by a normal of 1.74 points.

In comparison, Bristol’s medicine demonstrated a 1.4-point enhancement in an analogous study. At least two judges have expressed the view that the data reflects Aficamten’s “best-in-class” eventuality. This assessment suggests that Aficamten could stand out as a commanding seeker in the treatment of heart complaints, attracting significant interest from both the medical community and implicit investors.

Likewise, the positive study results have fueled enterprises’ interest in implicit buyout offers for Cytokinetics. The company has formerly attracted interest from major drugmakers, and fresh stab may have been staying for the study’s data before making their move.

It’s noteworthy that treatment with afikomen wasn’t intruded during the study, despite the lower situations of the heart’s capability to pump blood from the left ventricle. This adaptability in treatment underscores the medicine’s implicit benefits for cases with heart complaints.

Cytokinetics’ Mission

The South San Francisco, California, headquarters of the biopharmaceutical business Cytokinetics, Inc. As a covert therapy for diseases marked by impaired or deteriorating muscular function, the company’s principal emphasis is on creating muscle activators and muscle obstacles.

Current Stock Information

| Field | Value |

| Current Price | $44.60 (as of 2023-12-29, 3:31 EST) |

| Change | 0.00% |

| Volume | 105 |

| 52-week High | $47.09 |

| 52-week Low | $25.98 |

| Market Capitalization | $8.16 billion |

| Shares Outstanding | 98.05 million |

Historical Data

| Date | Open | High | Low | Close | Volume |

| 2023-12-28 | $44.41 | $46.00 | $43.21 | $44.60 | 105 |

| 2023-12-27 | $44.12 | $44.56 | $43.75 | $44.12 | 123 |

Technical Indicators

| Indicator | Value |

| Beta | 0.99 |

| P/E Ratio | N/A |

| EPS | -$5.52 |

| Dividend Yield | N/A |

| RSI | 99 |

Stock shot

Then’s a shot of Cytokinetics’ stock performance as of Thursday, December 28, 2023

• Current price$83.24

• 52- week high$85.62

• 52- week low$25.98

• request capitalization$8.16 billion

• Shares outstanding98.05 million

• Beta0.99

• P/ E rate N/ A

• EPS-$5.52

• tip yield N/ A

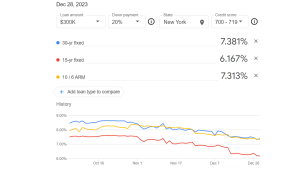

The Rollercoaster Lift of Cytokinetics Stock

Cytokinetics’ stock has endured significant volatility in recent months. Still, it has generally been on an upward trend since the morning of the time. The stock price saw a substantial swell in October 2023 when the company revealed positive results from a Phase 3 trial of its supereminent product seeker, omecamtiv mecarbil (OMT), for the treatment of heart failure with saved ejection bit (HFpEF). Nevertheless, the stock price has since retreated from its peak situation as investors eagerly await the results of fresh clinical trials.

Judges have offered mixed opinions on Cytokinetics’ stock. Some judges believe that the company’s channel of muscle-grounded curatives holds great pledges and has the implicit in being veritably successful. Still, others have expressed enterprises about the company’s lack of profitability and the essential pitfalls associated with medicine development.

Cytokinetics Annual Report (2022)

| Section | Key Points | |

| Financial Performance | * Net loss of $389.0 million | |

| * Revenues of $94.6 million | ||

| * Cash and equivalents of $829.3 million | ||

| Pipeline Progress | * OMT Phase 3 trial for HFpEF met primary endpoint (positive results announced December 2023) | |

| * CK-314 phase 2b trial for ALS ongoing | ||

| * Other pipeline candidates in various stages of development | ||

| Management & Governance | * Robert G. Blum, Ph.D., President and CEO | |

| * Board of Directors includes experienced industry leaders | ||

| Future Outlook | * OMT commercialization potential in HFpEF | |

| * Expanding pipeline with potential for multiple blockbuster drugs | ||

| Risk Factors | * Clinical trial failures | |

| * Competition from other drug developers | ||

| * Dependence on future funding |

High- threat, High- price

Cytokinetics’ recent success with aficamten in the late-stage study has propelled the company into the limelight. The swell in its stock price reflects the excitement and sanguinity girding this advanced medicine. With the eventuality of substantial profit and the possibility of buyout offers, Cytokinetics is a high-threat, high-price investment.

Investors should consider the pitfalls and prices associated with Cytokinetics’ stock before making any investment decisions. While the company has the implicit to be a major player in the muscle-grounded remedy request, it also operates in an assiduity known for its challenges and misgivings.

As Cytokinetics continues its trip towards nonsupervisory blessing and implicit request success, it remains a witching and dynamic player in the world of medicinals. Keep a close eye on this company as it works towards perfecting the lives of individuals with heart complaints and other conditions through innovative curatives like Aficamten.

+ There are no comments

Add yours